The Perfect Storm: How America Created a Student Debt Crisis

If you’ve been on social media lately, you’ve seen the explosion: outrage, mockery, and fear over student loan payments starting again. Some people sneer, “You signed the contract — pay it back.” Others cry out that wage garnishments and financial ruin are just the latest form of systemic oppression.

And honestly? I get both sides.

Because I’m living it.

I went to Lyndon State College in Vermont from 2015 to 2019. I did everything they told me to do — earned a Bachelor’s degree in Journalism, a minor in Atmospheric Sciences, worked a full time job, led student groups, worked hard academically and socially. I believed in the promise that if you worked hard and went to college, you'd build a future.

Even with scholarships and neighboring state discounts, I borrowed about $40,000 per year — around $20,000 per semester — just to cover tuition, housing, and the basics. Everyone around me said, “You’re smart. You’re hardworking. You’ll figure it out.”

No one could have predicted COVID-19 would wipe out my first real job less than a year after graduating.

Today, I work in New York City — a career I love, but one that doesn't come close to supporting the crushing burden of debt, rent, groceries, and survival in one of the world’s most expensive cities. I want to pay my loans. I really do. But after years of career setbacks, skyrocketing living costs, and starting from scratch after COVID, I simply can’t.

Sometimes, I can’t even afford a subway fare.

Sometimes, I have to jump the gate just to get to work.

I’m almost 30. I’ve built no savings. I can't afford a car, let alone a house. My parents — who took out Parent PLUS loans believing they were helping me secure a future — are now trapped in this system too. And the shame that comes with needing their help at this age is something I carry heavily.

That’s the real human cost of the American student debt crisis — the one that both sides of the political screaming match seem to miss.

College Used to Be a Public Good

Once upon a time, college wasn’t a personal gamble.

It was a national project.

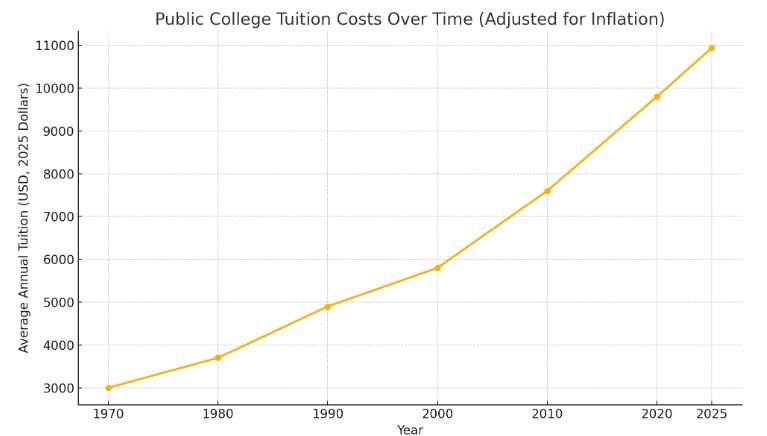

After WWII, the GI Bill paid full tuition for millions of veterans. States like New York and California built public universities that were almost free. In 1970, it cost the equivalent of about $3,000 a year to attend a four-year public college — and the state picked up 75–80% of the costs.

College was treated like highways and hospitals: essential to a strong economy and democracy.

The Great Disinvestment

Starting in the 1970s, everything changed.

Facing budget crises and tax revolts, states began cutting university funding. Meanwhile, federal aid shifted from grants to loans — fast. In 1975, states funded 75% of public university budgets. By 2025, it's below 30%.

Students were expected to make up the difference — through debt.

The University Arms Race

Instead of adapting, universities escalated.

Prestige became everything.

Lazy rivers. Rock climbing walls. Gourmet dining halls. And administrative bloat — universities hired armies of non-teaching staff, driving up costs even more.

Students weren’t just paying for education anymore — they were financing luxury branding wars.

The Financial Industry Moves In

Meanwhile, lenders realized there was a fortune to be made.

Companies like Sallie Mae and Navient lobbied Congress to make student loans undischargeable through bankruptcy, trapping borrowers no matter what.

Today, over $1.8 trillion in student debt exists.

A profit machine — fueled by the dreams of kids like me.

The Biggest Myth: "College is Always Worth It"

We were sold a lie.

Yes, some degrees pay off.

But not all.

And certainly not at any cost.

Starting salaries for many humanities, arts, and social science graduates simply can’t support massive debt burdens. Yet the cultural messaging — from parents, schools, media — never changed. College was always "the right choice."

The Human Cost

This isn’t just a numbers story. It’s a human one.

Black graduates owe $25,000 more on average than white peers.

Student debt is tied to depression, anxiety, even suicide.

Millennials and Gen Z are delaying homeownership, marriage, family.

Some are even leaving the U.S. entirely for cheaper lives abroad.

I feel all of this in my bones.

The stagnation. The shame. The sadness.

The quiet understanding that no matter how hard I work, I’m running uphill in a system rigged to see me drown.

The Political Freakout

Watching the political meltdown today feels almost cruel.

The right mocks us for not "taking responsibility."

The left screams for forgiveness without always acknowledging reality.

The truth is more complicated.

Borrowers like me signed contracts — but the game was already rigged.

Most Americans — like me — are stuck in the middle.

We want real reform.

We want compassion without naivety.

We want a system that doesn't crush future generations before they even begin.

Where We Go From Here

The American student debt crisis wasn’t an accident.

It was engineered — over decades — by political neglect, financial greed, cultural denial, and public disinvestment.

Fixing it isn’t about assigning blame or offering blanket forgiveness. It’s about:

Reinvesting in public higher education

Regulating tuition and university spending

Reforming loan programs with real protections

Rebuilding a culture that values truth over myths

We have to tell the next generation the truth:

College can open doors — but it can also trap you if you're not careful.

I don’t regret who I became.

But I wish someone had given me the full picture before I borrowed my future.

Want to see the full academic research behind this post?

I published a full in-depth research paper — packed with historical data, charts, figures, and references — over on my Research Page

(Highly recommend if you want the complete story!)Disclaimer:

This blog post is intended for informational and storytelling purposes only. The personal experiences, opinions, and reflections shared here are based on my individual journey and research regarding the U.S. student debt crisis. While care has been taken to ensure the accuracy of historical data and references, readers should consult primary sources or financial professionals for personalized advice. This post does not constitute financial, legal, or educational counseling. All figures, facts, and historical information are accurate to the best of my knowledge at the time of publication.